TDS Return Filing

Government Issued Documents

- GST Return Filing

- TDS Return Filing

- Income Tax Return Filing

- Payroll Processing

- PF Return Filing

- ESI Return Filing

- LEDGERS Platform

- LEDGERS HRMS

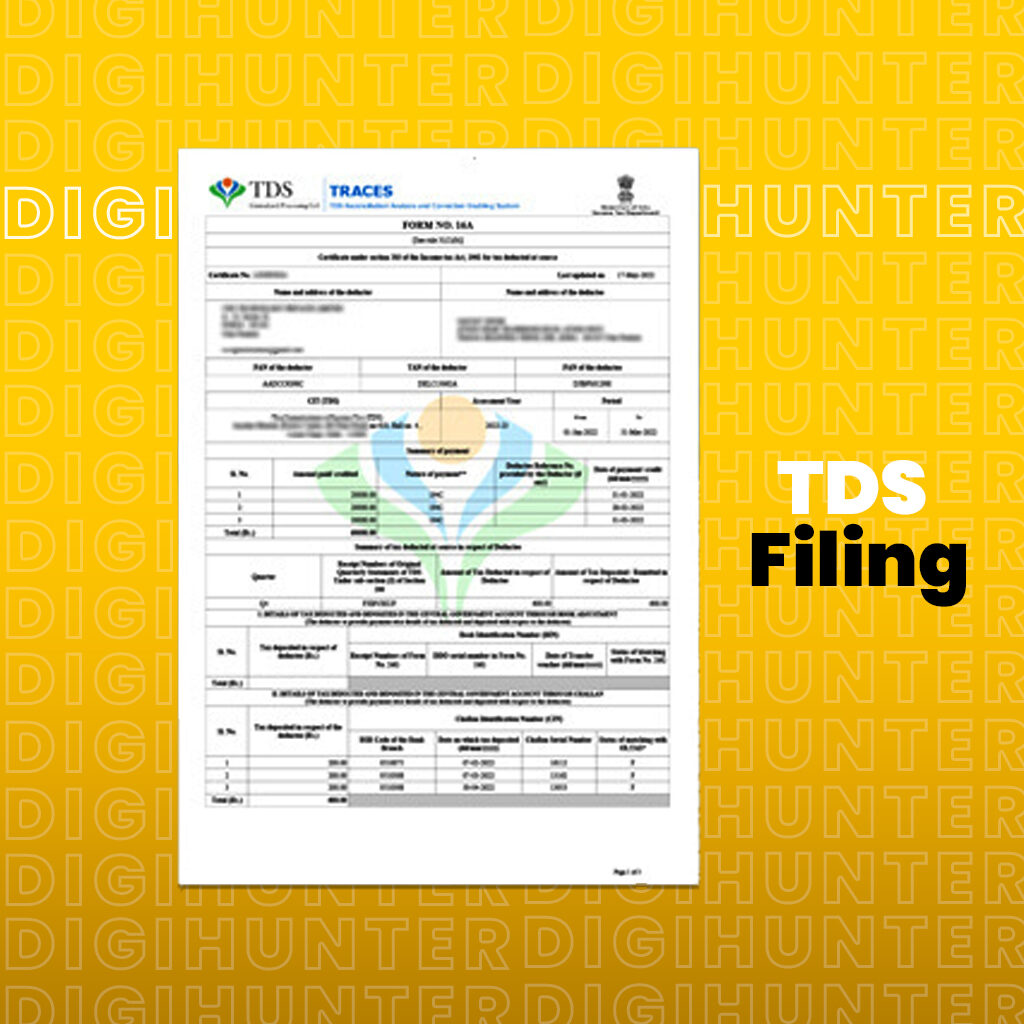

Documents Required

- TDS Acknowledgement

- PAN Card

- Tax Payment Challan

- Bank Statement

TDS Return Filing

What is TDS return filing?

Apart from depositing the tax the deductor also has to do TDS return filing. TDS return filing is a quarterly statement that is to be given to the Income Tax department. It is necessary to submit the TDS returns on time. TDS return filing can be done completely online. Once the TDS returns are submitted the details will come up on Form 26 AS. While filing the TDS returns the various details to be mentioned are:

- PAN of the deductor and the deductee.

- Amount of tax that is paid to the government

- TDS challan information

- Others, if any.

What is TDS?

Tax deducted at source or TDS is the tax that is collected by the Government of India at the time when a transaction takes place. Here, in this case, the tax is to be deducted at the time the money is credited to the payee’s account or at the time of payment whichever happens earlier.

In this case of salary payment or the life insurance policy, the tax is deducted at the time when the payment is done. The deductor is required to deposit this amount with the Income Tax Department. Through TDS a portion of the tax is paid directly to the Income Tax Department. The Tax is deducted usually over a range of 10%.

What is TAN?

TAN or the Tax Deduction and Collection Number is a mandatory 10 digit alpha number that is to be obtained by all the people who are responsible for deducting tax at source or tax collection at source on behalf of the government. Salaried individuals are not required to obtain TAN or to deduct the tax at the source.

In the case of the proprietorships businesses and other entities are required to deduct tax at the source while making certain payments like the salary, payments to the contractor, payment of rent that is exceeding Rs.2,40,000 per year. Digi Hunter can help in obtaining the TAN registrations.

The entities that have a valid TAN registration have to file the TDS returns quarterly. Our TDS experts can help in computing the TDS payments and file the TDS returns while complying with the TDS regulations.

Eligibility Criteria

Who can file TDS returns?

TDS return filing is done by organizations or employers who have availed a valid tax collection and deduction number (TAN). Any person who is making specified payments mentioned under the Income Tax Act is required to deduct the taxes at the sources and they are needed to deposit the tax within the stipulated time for making the following payments.

- Salary Payment

- Income on securities

- Income by winning the lotteries, puzzles, and others.

- Income from winning horseraces

- Insurance commissions.

- Payment concerning the National saving scheme and many others.

Due Date for TDS Return filing

What are the due dates for TDS return filing?

The due date for the payment of the TDS deducted is the seventh of the next month.

FAQ's

Tax deducted at source is the practice of reducing the tax evasion and the spillage by TDS payment mandatory at pre refined rates.

TDS was introduced to collect the tax from the source of income. Here the deductor who is liable to make payment to the deductee should deduct the tax at source and remit the same into the account of the central government.

TDS is deducted only the total income is taxable, the TDS will not be deducted in case the total income is Rs 2,50,000 and this amount is applicable for both men and women below the age of 60 years.

There is a penalty for not depositing or not deducting TDS on time, the employer can make the interest payment on such late payment of the TDS before filing the TDS returns or the demand raised by TRACES.

First compute the exemptions that are available under Section 10 of the Income Tax (ITA) then subtract the exemptions that are found in step (2) from the gross monthly income calculated in step (1), multiply the obtained number from the above calculation by 12 as the TDS is computed on the yearly income.

Related Business Registrations

In addition to registration or incorporation, a business may require other registrations depending on the business activity undertaken. Talk to an Advisor to find out registrations your business may require post registration.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Sole proprietorship | One Person Company | Nidhi Company | Company Registration | Tax Notice | Indian Subsidiary | HSN Code | Section 8 Company | Trademark Search | USA Company Registration | FSSAI Registration | Import Export Code | ESI Registration | GST Return Filing | Patta Chitta | PF Registration | Payroll | Business Tax Return Filing | PF Return Filing | Eway Bill | GST Registration | TDS Filing | Udyam Registration | Trademark Registration | Startup India Registration | Professional Tax | Personal Tax Filing .

Our Services in

Andhra Pradesh | Arunachal Pradesh | Assam | Bihar | Chhattisgarh | Goa | Gujarat | Haryana | Himachal Pradesh | Jammu and Kashmir | Jharkhand | Karnataka | Kerala | Madhya Pradesh | Maharashtra | Manipur | Meghalaya | Mizoram | Nagaland | Odisha | Punjab | Rajasthan | Sikkim | Tamil Nadu | Telangana | Tripura | Uttar Pradesh | West Bengal.