Life Insurance

Life Insurance in its modern form came to India from England in the year 1818. Oriental Life Insurance Company started by Europeans in Calcutta was the first life insurance company on Indian Soil. All the insurance companies established during that period were brought up with the purpose of looking after the needs of European community and Indian natives were not being insured by these companies. However, later with the efforts of eminent people like Babu Muttylal Seal, the foreign life insurance companies started insuring Indian lives. But Indian lives were being treated as sub-standard lives and heavy extra premiums were being charged on them. Bombay Mutual Life Assurance Society heralded the birth of first Indian life insurance company in the year 1870, and covered Indian lives at normal rates.

Starting as Indian enterprise with highly patriotic motives, insurance companies came into existence to carry the message of insurance and social security through insurance to various sectors of society. Bharat Insurance Company (1896) was also one of such companies inspired by nationalism. The Swadeshi movement of 1905-1907 gave rise to more insurance companies. The United India in Madras, National Indian and National Insurance in Calcutta and the Co-operative Assurance at Lahore were established in 1906. In 1907, Hindustan Co-operative Insurance Company took its birth in one of the rooms of the Jorasanko, house of the great poet Rabindranath Tagore, in Calcutta. The Indian Mercantile, General Assurance and Swadeshi Life (later Bombay Life) were some of the companies established during the same period. Prior to 1912 India had no legislation to regulate insurance business. In the year 1912, the Life Insurance Companies Act, and the Provident Fund Act were passed. The Life Insurance Companies Act, 1912 made it necessary that the premium rate tables and periodical valuations of companies should be certified by an actuary. But the Act discriminated between foreign and Indian companies on many accounts, putting the Indian companies at a disadvantage.

The first two decades of the twentieth century saw lot of growth in insurance business. From 44 companies with total business-in-force as Rs.22.44 crore, it rose to 176 companies with total business-in-force as Rs.298 crore in 1938. During the mushrooming of insurance companies many financially unsound concerns were also floated which failed miserably. The Insurance Act 1938 was the first legislation governing not only life insurance but also non-life insurance to provide strict state control over insurance business. The demand for nationalization of life insurance industry was made repeatedly in the past but it gathered momentum in 1944 when a bill to amend the Life Insurance Act 1938 was introduced in the Legislative Assembly. However, it was much later on the 19th of January, 1956, that life insurance in India was nationalized. About 154 Indian insurance companies, 16 non-Indian companies and 75 provident were operating in India at the time of nationalization. Nationalization was accomplished in two stages; initially the management of the companies was taken over by means of an Ordinance, and later, the ownership too by means of a comprehensive bill. The Parliament of India passed the Life Insurance Corporation Act on the 19th of June 1956, and the Life Insurance Corporation of India was created on 1st September, 1956, with the objective of spreading life insurance much more widely and in particular to the rural areas with a view to reach all insurable persons in the country, providing them adequate financial cover at a reasonable cost.

Insurance Plan

Pension Plan

Health Plan

Withdrawn Plan

Insurance Plan's

-

LIC’s BIMA JYOTI

Date of Launch : 20.12.2021

-

LIC’s BIMA JYOTI

Date of Launch : 20.12.2021

-

LIC’s BIMA JYOTI

Date of Launch : 20.12.2021

-

LIC’s Bima Ratna

Date of Launch : 27.05.2022

-

LIC’s Dhan Sanchay

Date of Launch : 14.06.2022

-

LIC’s Jeevan Azad

Date of Launch : 19.01.2023

-

LIC’s Dhan Vriddhi

Date of Launch : 23.06.2023

-

LIC’s NEW ENDOWMENT PLAN

Date of Launch : 01.02.2020

-

LIC’s NEW JEEVAN ANAND PLAN

Date of Launch : 01.02.2020

-

LIC’S SINGLE PREMIUM ENDOWMENT PLAN

Date of Launch : 01.02.2020

-

LIC’s JEEVAN LAKSHYA

Date of Launch : 01.02.2020

Pension Plan's

-

LIC’s JEEVAN AKSHAY-VII

Date of Launch : 28.02.2023

-

LIC’S NEW JEEVAN SHANTI

Date of Launch : 05.01.2023

-

LIC’s SARAL PENSION

Date of Launch : 01.03.2023

Health Plan's

Withdrawn Plan's

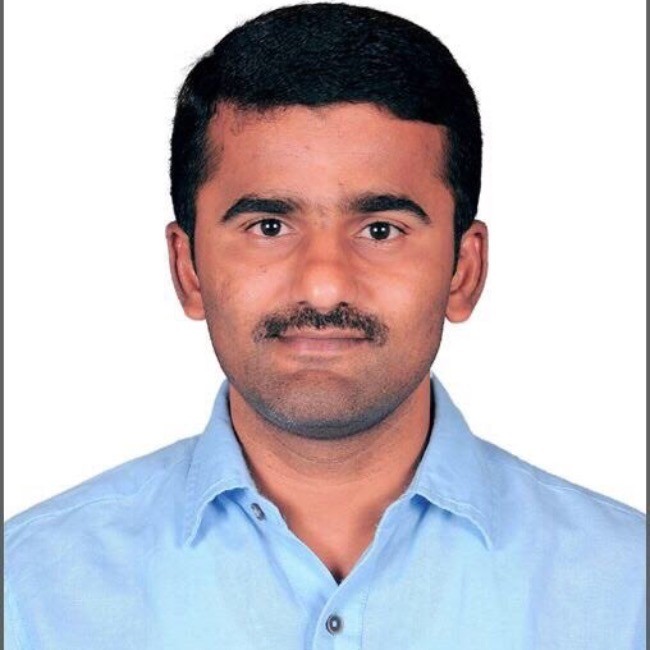

Our Expertise in this Industry from India

Mr.Prasanna KUMAR S

Bangalore- 13 Year Experience

Mr.Jagdish Ageawal

Madhya Pradesh - 8 Year Experience

MDRT – 2023

Mr.Kiran Mohite

Mumbai- 12 Year Experience

Mr.M G Reddy

Hyderabad - 9 Year Experience

Mr. Kevin John Paul J

Pudukkottai - 4 Year Experience

Mr.Saravanan

Chengalpattu - 15 Year Experience

Mr.Venugopal M

Chennai – 14 Year Experience

Mr.Venugopala has been providing insurance to people around the Bay Area since 1991. He believes that putting his clients first and maintaining a high level of professionalism on their behalf is what makes clients eager to refer him to their family and friends. Venugopala brings a high level of expertise to his clients and works diligently with them to find a plan that meets all of their concerns.

Mr.Venugopala specialty lies in business and personal life insurance. He has been married and has two grown sons, a daughter-in-law and three grandchildren. Each winter, you’ll find Venugopala coaching high school basketball. He has been a coach for 11 years and loves working with athletes.

Kevin John Paul J

4 Year as LIC Agent

Pudukkottai

Pavendan

7 Year as LIC Agent

Thoothukudi

Santhnam

15 Year as LIC Agent

Tiruvallur

Raghupathy

7 Year as LIC Agent

Coimbatore

Sudhakaran

15 Year as LIC Agent

Chennai